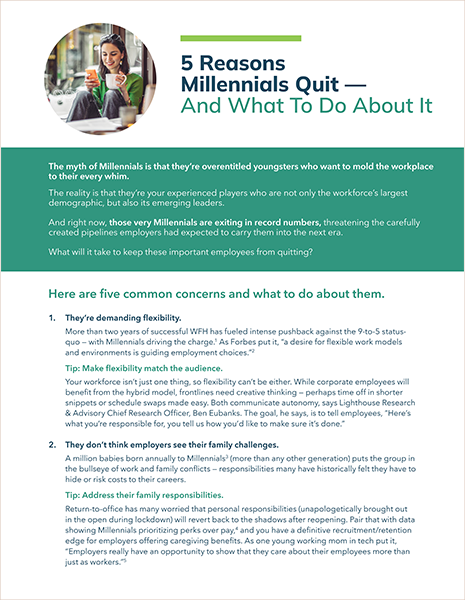

The following guest blog post comes from Ben Eubanks, Chief Research Officer at Lighthouse Research & Advisory. In this role, he works with HR, talent and learning leaders across the globe to solve their most pressing business challenges with a research-based perspective tempered by practical, hands-on experience.

I have kids that range from five to 12 years of age, and their interests have changed as they have aged.

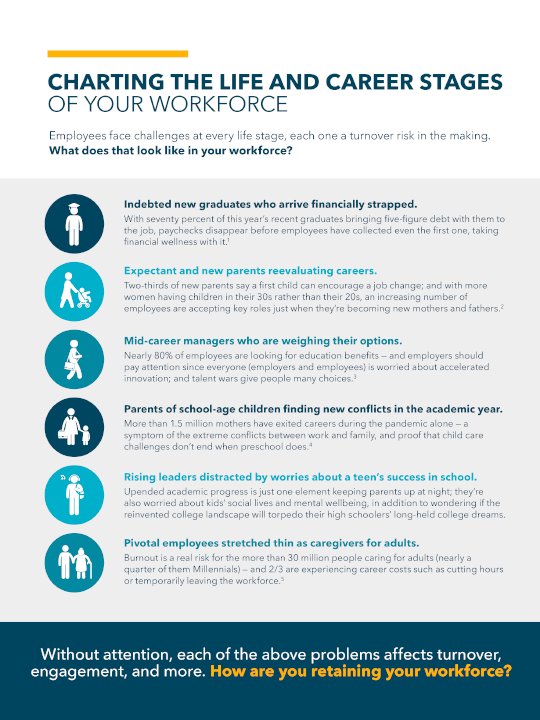

From car seats to cartoons to cell phones, they have different priorities as they move along the spectrum of age. This same phenomenon happens at work. Someone who is just entering the workforce has different priorities from a benefits perspective than someone who is 20 or 30 years into their career, and employers who offer a one-size-fits-all approach to their benefit offerings are missing a chance to meet the needs of the workforce.

To put it a different way: a diverse workforce needs diverse benefits. And in today’s day and age with five generations in the workforce, as you’ll see below, it can quickly become complex and challenging to address the dynamic needs of everyone both across age groups and as individuals in a meaningful way.

Deciphering Work Priorities by Age

A worker in their 20s is much more likely to be interested in student loan repayment than a worker in their 40s. Generally, we know that’s true.

But when you start to examine what people care about in the workplace, you start to see just how different people can be. In our Great Reprioritization study that looked at thousands of American workers, my team found that employees in different age groups don’t just have different preferences: we found that not a single pair of age groups share the same top priorities at work.

It’s important to note that while most of these options vary across age groups, a healthy benefits package ranks highly for virtually every group as a priority. Additionally, some of these aren’t “benefits” per se, but they tie into the things employers offer on that front. For example, if someone prioritizes work/life balance, any benefits that support someone’s ability to work in a flexible manner can be included. Additionally, if career growth is a top preference, any options for tuition reimbursement or development opportunities can help to meet that need.

This provides a visual reminder of just how different people can be based on their age, life stage, or other demographic factors, but let’s take it a step further and examine what impacts these offerings can have on someone’s loyalty to their employer.

The Impact of Flexible, Employee-Focused Benefits

In the book Giftology, the author makes the case that gifts can be a way to build strategic relationships for sales, customer retention, and more. One of the biggest takeaways from that book is pretty simple: we often give gifts that we want to give instead of giving the gifts that our recipients want to receive.

The same thing happens with employee benefits. Employers make decisions about what benefits to offer based on what they think people want instead of understanding and offering what people actually desire.

Let’s look at some data to shed light on this. Recently my team conducted a study on flexible benefits. We asked workers if they could use their accrued leave for other purposes than time off, what would they convert it into?

The findings were intriguing and show just how diverse people can be:

- Workers 54+ years old are nearly four times more interested in retirement contributions than workers 18-24.

- Younger workers are three times more interested in using funds for trips and travel than other workers.

- Emergency cash is the number one priority for every age group, but it varies by other demographics, such as income level: those with incomes over 100k would prefer to use funds for health savings accounts.

While this group of benefit options was somewhat narrowly defined, there are plenty of other choices for employers that want to offer a competitive, balanced, and robust benefits package.

The ROI of Offering Flexible Benefits

At the end of the day, leaders invest in benefits because they expect a payback, plain and simple. Yet we don’t always know what to tie back into benefits to prove their value.

In the flexible benefit study, we found that the top three outcomes that workers identified were as follows:

- I’d feel like my employer values and appreciates me

- I’d feel more loyalty to my employer

- I’d feel like I had more control over my life

What’s more we saw that nine out of 10 employees agreed that flexible benefit choices would make them more likely to stay with their employer.

Offering a broad, diverse range of benefits requires effort to identify, select, and manage. But the payoff in terms of employee loyalty and retention is powerful.

This has been backed up by science for some time. Psychologists have discovered that the pain of losing something we have is greater than the satisfaction of gaining something new. That supports this finding that employees would hesitate to leave an employer that offers them a well-rounded set of benefits that address their core life challenges (finances, family care, stress, etc.)

Because worker needs, desires, and priorities continue to evolve as they move through life and various life stages, employers that are willing to create a set of benefits that continue to address those top priorities will see the benefits of a more dedicated and committed workforce.